Article Summary (Key Points)

- Optimus Production Cost – Tesla aims to reduce Optimus’ production cost to $20,000 per unit at scale, though early units might cost $100,000+ due to limited volume.

- Optimus Sale Price – Tesla targets a sale price of $25,000 per unit, initially higher ($100,000+ for early enterprise buyers) before economies of scale reduce costs.

- Adoption Potential – If robots prove effective, Optimus could replace human workers in factories, logistics, retail, and elder care, where full-time labor costs $30,000–$50,000 per year.

- Sales Estimates (Optimistic) – By 2029, Tesla could sell 200,000+ robots per year, generating $5 billion in revenue annually at a 30% gross margin (~$1.5B gross profit).

- Sales Estimates (Realistic) – If scaling is slower, Tesla might sell 50,000 robots per year by 2029, with $1.5 billion annual revenue and $300 million gross profit (20% margin).

- Sales Estimates (Pessimistic) – If adoption lags, Tesla may only sell a few thousand total units by 2029, keeping revenue below $500 million, possibly running the segment at a loss.

- Market Cap Impact (Optimistic) – If Optimus reaches $1B in profit by 2029 with high growth, Tesla’s valuation could rise by $50 billion or more, potentially pushing total market cap above $1.5–$2 trillion.

- Market Cap Impact (Realistic) – With slower adoption (~50k units/year), Tesla’s market cap might reach $1–1.2 trillion by 2029, with Optimus adding $20–30 billion in value.

- Market Cap Impact (Pessimistic) – If Optimus remains a niche project, Tesla’s market cap may stay around $600–800 billion, with little contribution from humanoid robots.

- Tesla’s Production Scaling Goal – Musk envisions 1 million Optimus robots per year long-term, though hitting even 200k per year by 2029 would be ambitious.

- Factory Automation Influence – Tesla plans to deploy thousands of Optimus robots in its own Gigafactories by 2025, using them as an internal testbed before wider sales.

- Competitors – Agility Robotics (Digit), Boston Dynamics (Atlas), and startups like Figure AI could challenge Tesla, with Agility already building a 10,000-robot-per-year factory.

- Regulatory & Labor Risks – Governments might impose safety regulations or robot taxes, and labor unions may resist widespread robotic workforce replacements.

- Consumer Market Uncertainty – While Tesla envisions home robots, a $25,000 price tag is too high for mass adoption, making business applications the primary focus for now.

- Historical Adoption Patterns – Industrial robots took decades to reach 3 million units globally, meaning a humanoid revolution could be slower than Musk predicts unless major breakthroughs occur.

Tesla’s Optimus humanoid robot represents a bold expansion beyond electric vehicles, aiming to transform labor-intensive industries with automation. This analysis evaluates the Optimus segment’s potential contribution to Tesla’s market capitalization over the next five years. We consider direct sales to businesses and consumers, estimate production costs and pricing via first principles, assess likely adoption rates by industry, and outline three scenarios – Optimistic, Realistic, Pessimistic – for robot adoption and financial outcomes. We then apply a valuation approach using revenue and earnings multiples, referencing historical automation curves, while highlighting key risks (technological challenges, competition, and regulatory hurdles).

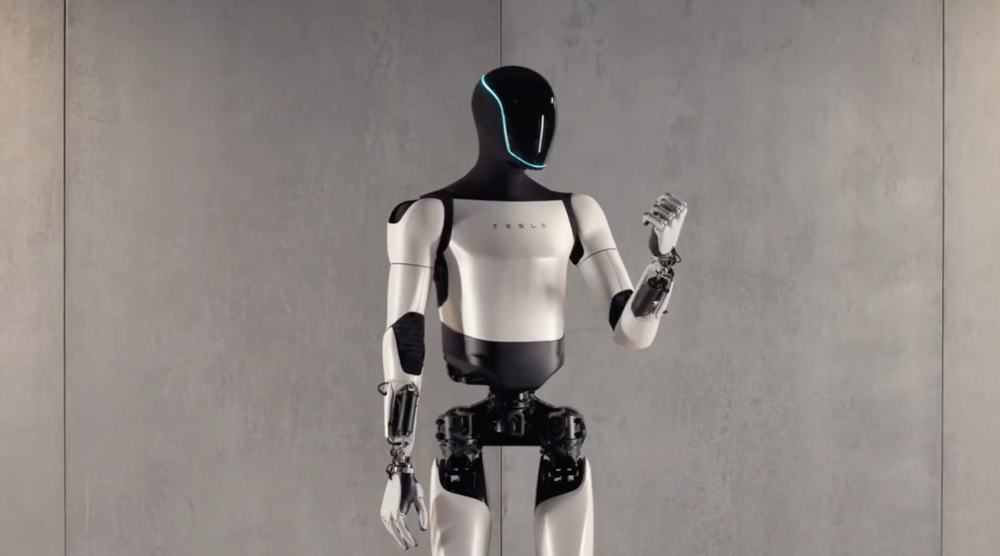

Tesla’s Optimus Gen-2 Humanoid Robot (2024), showcasing Tesla’s vision of a bi-pedal general-purpose robot.

Production & Assembly Cost Estimates – First Principles

Component Costs: Optimus is essentially an electromechanical system combining hardware (actuators, sensors, battery) and AI software. Using first-principles, we estimate:

- Materials: The robot frame likely uses lightweight metals (aluminum, possibly carbon composites) and plastics. Bulk material cost might be a few thousand dollars per unit at scale. For example, Boston Dynamics’ Spot (a quadruped) has a price of ~$74,500, reflecting expensive R&D and low-volume production. Optimus targets far lower cost by leveraging Tesla’s supply chain and high-volume production expertise.

- Actuators & Electronics: High-performance servos, electric motors, Li-ion battery cells, cameras, and sensors drive costs. At scale, Tesla could produce custom actuators in-house (similar to their electric vehicle motors). Bulk cost per motor might drop below $100 when mass-produced. The entire actuator/sensor suite could be several thousand dollars initially, trending down with volume.

- Labor & Factory Overheads: Early on, assembly involves significant skilled labor (robotics experts, engineers). Tesla might deploy advanced automation to build robots (a “robots building robots” paradigm). Initially, assembly cost per unit could be high (tens of thousands of dollars) due to low volume, but economies of scale are expected. Elon Musk has hinted that once production exceeds ~1 million units/year, the production cost per Optimus could fall below $20,000. This implies aggressive factory automation and learning curve effects reducing labor per unit dramatically.

- R&D and Tooling Amortization: Tesla has likely invested billions in R&D (e.g., a notional $2B already expensed) to develop Optimus. Initial units might carry a cost premium to recoup this. For instance, early low-volume Gen-1 prototypes might “cost” hundreds of thousands each (similar to one-off robots in labs). However, by Gen-3 with refined design, Tesla expects to “use existing Gigafactory capacity” and spend an additional ~$20B to scale production. These investments (for tooling, supplier contracts, new facilities) would amortize over millions of units.

Factory Scaling: Tesla is building new production lines (possibly at Gigafactories or dedicated “Bot” factories). Agility Robotics’ new RoboFab factory (70,000 sq. ft.) can produce up to 10,000 humanoid robots per year, indicating the physical scale needed. Tesla, envisioning hundreds of thousands to millions of bots, will need much larger facilities or multiple factories. They might repurpose parts of existing Gigafactories. Economies of scale should drive per-unit costs down sharply after the first ~50,000 units.

In summary, initial production & assembly cost per Optimus could be ~$100,000+ in early pilot builds (2024–2025), but with design iteration and volume manufacturing (by 2028–2030), it could drop to ~$20,000 or less. For our five-year scope, a reasonable cost estimate by year five (2029/2030) is $25,000 per unit (assuming some scale, but not yet millions/year).

👉 Recommended Article: Tesla Bot Optimus: Is $5,000 per Share (TSLA) Realistic?

Market Pricing Estimates

Target Price Range: Elon Musk indicated Optimus should cost “less than a car,” roughly $20,000–$30,000 at scale. This suggests Tesla aims to price Optimus in the price range of a mid-level sedan. By positioning it at ~$25,000 in the long run, Tesla signals mass-market ambitions (both for businesses and eventually consumers).

- Initial Pricing Strategy: Initially, to cover high R&D and low volume, Tesla might price Optimus higher (perhaps $100,000+ for early units sold in 2025–2026 to enterprise clients, similar to how new tech is often premium-priced). Early adopters (factories, logistics firms) might pay a premium if the robot demonstrably fills labor gaps. However, to achieve wide adoption, Tesla would need to rapidly reduce the price.

- Competitive Benchmarking: Today’s advanced humanoid robots (often research prototypes like Boston Dynamics’ Atlas) cost in the high six figures (if they were sold). Simpler commercial robots like Agility’s Digit or industrial robot arms can cost tens of thousands. Agility’s Digit robot is rumored to be priced around $70k–$100k for early partners, though official prices aren’t widely published. Tesla likely subsidizes initial pricing expecting future economies of scale – a strategy similar to how Tesla approached EV pricing (high initial price, then introducing cheaper models).

- Consumer vs. Business Pricing: For businesses, the value proposition is cost savings (labor replacement or augmentation). A $25k robot that can work 20 hours/day could be compelling if it replaces a human worker (with fully loaded annual cost $30k–$50k). For consumers, $25k is steep, so initial consumer adoption might be limited to high-income or special-needs scenarios. Over time (beyond five years), consumer prices may need to drop below $20k or Tesla might introduce financing models (e.g., robots-as-a-service or leasing).

Profit Margin Targets: Tesla historically enjoys healthy margins on EVs, and Musk suggested robot manufacturing cost could be ~60% of sale price, implying 40% gross margin. If Optimus sells for $25k, cost of goods target is ~$15k (long-term). Achieving this in five years is ambitious; realistically, margins might be thin or negative in early years, then improving with scale. For scenario modeling:

- Optimistic: Gross margin ~30-40% by year five (high volume, efficient production).

- Realistic: Gross margin ~20% by year five (moderate scale).

- Pessimistic: Break-even or low single-digit margin (if costs stay high or price must be cut to drive adoption).

Adoption Rates by Industry & Use-Cases

Tesla’s Optimus is touted as a general-purpose, bipedal robot aimed at performing “unsafe, repetitive or boring” tasks. Adoption will vary by industry based on need and ROI:

- Manufacturing & Warehousing: Likely early adopters. Robots can work alongside humans or in lights-out environments to perform material handling, assembly, or packaging. Labor shortages and rising wages drive interest. Tesla itself plans to deploy “a few thousand Optimus robots in its factories by end of 2025” as a testbed. If successful, other manufacturers could follow. Over five years, factories might adopt robots for palletizing, machine tending, or intralogistics. Adoption Rate: Optimistic: 5-10% of large factories pilot or deploy some robots. Realistic: 1-5% of factories, mostly trials. Pessimistic: Niche trials only, <1%.

- Logistics & Retail: Tasks like lifting boxes, moving goods in warehouses, or restocking shelves could be done by humanoid robots. Amazon’s investment in robotics (e.g., Agility’s Digit) shows industry appetite. A nimble humanoid can go where forklifts or fixed conveyors can’t. Over five years, large warehouse operators might incrementally add robots (dozens to hundreds) if they prove reliable. Retail in-store use (like shelf scanning or customer assistance) is possible but likely later due to complexity. Adoption Rate: Optimistic: Major logistics firms deploy robots in several warehouses; hundreds per company. Realistic: Focused pilots (tens of robots). Pessimistic: Limited tests, waiting for tech maturity.

- Healthcare & Service: In elder care, hospitals, or hospitality, humanoid robots could assist with lifting patients, delivering supplies, cleaning, or security patrols. While potential is high (e.g., helping aging populations), regulatory and social acceptance hurdles exist. Within five years, expect small-scale deployments in controlled environments (some hospitals using robots for delivery, senior homes piloting one robot for assistance). Adoption Rate: Optimistic: Many pilot programs, early robot “orderlies” in top hospitals. Realistic: Few high-profile trials. Pessimistic: Very limited due to safety/regulation.

- Consumers (Home Robots): This is perhaps the most transformative but also the most uncertain segment. A truly useful home robot (for cleaning, lawn mowing, fetching items, companionship) at reasonable cost could see massive demand – Musk even mused “everyone’s going to want their Optimus buddy”. However, technical capabilities may not meet the broad expectations within five years. Early adopter consumers might be those with disabilities or high income tech enthusiasts. Adoption Rate: Optimistic: Tens of thousands of wealthy/global early adopters buy a Tesla Bot as a novelty or helper by 2029. Realistic: Very few consumer sales (technology not ready or price too high). Pessimistic: Essentially zero consumer uptake in five years (focus remains B2B).

Incentives for Business Adoption: The primary driver is ROI via labor replacement or augmentation:

- Robots can work 24/7 without breaks, potentially boosting productivity. For instance, one Optimus working three shifts could replace 2-3 human workers in certain roles, yielding savings after the upfront cost.

- Industries with labor shortages or high injury risk (e.g. mining, agriculture, construction) have strong incentives to automate dangerous or undesirable jobs. Optimus could be attractive if it reduces injury liability and fills roles humans don’t want.

- Consistency and precision: Robots provide consistent output, which can improve quality and reduce waste in manufacturing processes.

- For Tesla, using Optimus internally can reduce car production costs, indirectly boosting margins on Tesla’s core business (a strategic incentive).

Adoption Hurdles: Despite incentives, companies will weigh:

- Reliability: Robots must operate with minimal downtime. Early versions might be prone to failures or require lots of maintenance (as seen with many new robotics technologies).

- Integration: Workplaces must be modified to accommodate robots (safety protocols, layout changes). Not all facilities can easily integrate a bipedal robot without planning.

- Workforce reaction: Unions or employee groups may resist rapid robot deployment if it threatens jobs, potentially causing industrial relations issues or requiring careful change management.

Given these factors, initial adoption (2025–2027) will likely be cautious – small pilots proving the business case. If those are successful, late-decade adoption (2028–2030) could accelerate in the optimistic scenario.

Scenario Analysis – Optimus Segment Impact

We develop three scenarios with assumptions on unit sales, margins, and adoption pace:

1. Optimistic Scenario (Widespread Adoption)

Adoption & Sales: In this scenario, Tesla overcomes technical challenges swiftly. By 2025, Optimus is commercially available and industries eagerly adopt. Assume:

- Units Sold: Perhaps 50,000 units/year by year 3 (2027), scaling to 200,000+ units/year by year 5 (2029). This would be extraordinary growth, akin to Tesla’s Model 3 ramp but in robotics. Widespread industry acceptance means multiple sectors use Optimus, and Tesla even starts limited consumer sales (e.g., a home robot variant).

- Market Penetration: Tesla captures a substantial share of the robotics market. If the overall robotics (humanoid + other) market is ~$50B by 2027, Tesla’s humanoid could take, say, 10-20% of the addressable tasks (given few competitors at scale). Musk even floated reaching 25% of the overall robotics market in 5 years, which is highly ambitious. Optimistic case: Tesla gets to ~15-25% of relevant market by 2029.

Production Efficiency & Costs: High volume enables Tesla to refine manufacturing:

- Gigafactories achieve automotive-like throughput for Optimus. Perhaps 1+ million units cumulative produced over 5 years.

- Economies of scale push unit cost down toward the $20k target. Let’s say by 2029, cost per robot ~$18,000.

- Sale Price: Could drop to ~$25,000 (Tesla passes some cost savings to drive volume). At $25k, if cost is $18k, gross margin ~28%. Tesla may also offer software subscriptions for advanced capabilities, boosting effective ASP (Average Selling Price).

Revenue & Earnings: By 2029, Optimus segment revenue could be significant:

- If 200k units sold at $25k = $5 billion annual revenue. If Tesla introduces higher-end models or charges for software, revenue could be higher.

- With ~30% gross margins and some operating leverage, net margins might be ~20% (given R&D and SG&A scaling). So $5B revenue yields ~$1B net profit from robots annually by year 5.

However, Musk’s truly optimistic vision goes further: He hinted at “1 million robots a year” at steady state and even 10 billion robots by 2040 globally (far beyond our 5-year scope). In the 5-year optimistic scenario, we stick to high but somewhat plausible numbers (hundreds of thousands, not millions, of units).

Market Cap Contribution: If in five years, Optimus is generating $1B in profit and growing fast, how much is that worth? Tech stocks often trade at high P/E multiples for growth segments. If we apply a PE of 50 (reflecting high growth expectations), that portion could be worth $50B. However, if investors see robots eventually overtaking Tesla’s auto business, they could price in a much larger future. Musk claimed Optimus could make Tesla a $2.5 – $25 trillion company long-term, which is extremely speculative. For five years out, under the optimistic scenario, Tesla’s total market cap might be, say, $1.5 – $2 trillion (with Optimus accounting for a significant chunk of the upside). This assumes Tesla’s EV, energy, and autonomy businesses also grow, but Optimus provides a major new revenue stream.

- Comparison to History: A rapid adoption curve here mimics smartphone or PC adoption rather than historical robots. Industrial robots took decades to reach 3 million in operation worldwide. Achieving ~0.2 million humanoid robots in five years would be unprecedented growth – hence “optimistic.” The scenario presumes the technology is so revolutionary and cost-effective that adoption outpaces the typical automation curve.

2. Realistic Scenario (Moderate Adoption & Steady Growth)

Adoption & Sales: In this balanced scenario:

- Optimus development continues, but scaling is slower due to technical and production challenges. By 2025, Tesla has a few hundred bots in its own factories (as planned), and sells limited units to strategic partners. Broader commercial sales maybe start in 2026–2027.

- Units Sold: Perhaps 5,000 units in 2026, growing to 20,000–50,000 units/year by 2029. This might mean a cumulative ~100k robots deployed in five years – significant, but not world-changing yet.

- Adoption is sector-specific: primarily large factories and warehouses with capital to experiment. Others wait for proof of ROI. Tesla might announce big orders (e.g., an automaker orders 1,000 bots for its plants in 2028 if early trials are good).

Production & Costs:

- Tesla faces scaling challenges (similar to early Model 3 “production hell”). Maybe delays in building the Optimus production line or unforeseen technical hurdles (e.g., actuator supply constraints) keep costs higher longer.

- By year 5, manufacturing is more efficient but not fully optimized. Unit cost could be ~$25,000.

- Sale Price: Possibly $30,000+ in this period, since demand is there but Tesla hasn’t slashed price yet. Tesla may still be recouping investment, so perhaps they price at $30k (with discounts on bulk orders).

- Gross margin might only be ~15-20% by year 5 (still ramping to target, and maybe Tesla competes on price to entice adopters).

Revenue & Earnings:

- At 50,000 units/year * $30k = $1.5B annual revenue by 2029. If net margins are say 10%, that’s $150M profit from the segment. More likely, net margins could be near zero in initial years (reinvesting in R&D, etc.) and turn positive by year 5.

- Cumulatively, over five years, the segment might contribute a few billion in revenue but only modest profit as it scales.

Market Cap Contribution:

- Investors may value the segment on potential rather than current profit. If by 2029 Optimus is clearly gaining traction with, say, 50k units/year and growing, the market will project future growth. Perhaps they assign a value of $20–30B to the robot business (e.g., a price-to-sales of ~10 on $3B sales expected a year or two beyond).

- Tesla’s total market cap in this scenario might be perhaps $1–1.2 trillion (growing vs. today but not exploding), with Optimus being one promising contributor among others (EVs, energy storage, etc.). It’s not yet the dominant story, but it adds a layer to Tesla’s tech narrative.

- Historical Parallel: This would mirror the early stage of past innovations – e.g., how Amazon’s AWS was a small part of revenue early on but had high strategic value. Or akin to how industrial robot adoption grew ~11% CAGR over years – steady but not instant ubiquity. A CAGR of, say, 50% in robots (from 5k to 50k units/year in 5 years) is fast but plausible in a niche.

3. Pessimistic Scenario (Slow Adoption & Challenges)

Adoption & Sales: Here, the road is rough:

- Technical limitations keep Optimus from being truly useful in varied tasks. It can do simple things, but perhaps human-level dexterity or autonomy isn’t achieved yet. Early pilot customers report frequent issues; some scale back trials.

- Units Sold: Only a few hundred in the first couple of years (2025–2026), mostly to Tesla for internal use and a handful to research partners. By 2029, maybe a few thousand total units in the field. Many potential clients take a “wait and see” approach, or competitors offer better niche solutions (e.g., specialized warehouse robots outperform a general humanoid for less cost).

- Market Penetration: negligible in most industries. The humanoid remains a curiosity or in limited roles (like how Honda’s Asimo never commercialized despite two decades of development).

Production & Costs:

- Without volume, costs remain high. Maybe Tesla hasn’t cracked high-speed production; each robot is semi-hand-built by technicians. Cost per unit might stay ~$100k or more in 2025–2027, limiting Tesla’s ability to cut price.

- Sale Price: Tesla might price each unit at $100k+ initially, which further dampens demand beyond R&D partners. Even if they lower it to, say, $50k by 2029, it’s still expensive for what it can do.

- The division could be a money sink – continuous R&D and capex without profitable returns in five years.

Revenue & Earnings:

- If only 5,000 units total are sold over five years at an average price of, say, $75k (starting high, coming down slightly), that’s ~$375M cumulative revenue – relatively insignificant for a company the size of Tesla.

- The segment likely runs at a loss (R&D expenses in the billions vs. meager revenue). In accounting, Tesla might even classify it under “Other” with minimal effect on overall financials.

Market Cap Contribution:

- Investors may discount the Optimus project entirely in valuation, seeing it as a moonshot that hasn’t panned out yet. Tesla’s market cap would then rely on its core EV/energy businesses. If those do fine, Tesla could still grow, but let’s say Optimus adds negligible value. Possibly even a slight drag if investors fear Tesla is overspending on a dream.

- Tesla’s market cap in 5 years under this scenario might be maybe $600–800B (incremental growth from EV business, but nowhere near the trillions, and Optimus hopes are postponed). Some might compare Optimus to other failed robotics ventures (e.g., SoftBank’s Pepper which halted production or Rethink Robotics’ collapse) – a cautionary tale, though Tesla likely wouldn’t give up entirely.

- Historical Note: This scenario mirrors the fact that humanoid robots have historically been very challenging to commercialize. Honda’s Asimo never made it to market, Boston Dynamics’ Atlas remains a research platform, and even successful robot makers often stick to simpler designs (robot arms, Roomba vacuums, etc.). So a slow trajectory wouldn’t be surprising in context.

Valuation Approach – Revenue and Earnings Multiples

To estimate Tesla’s future market cap from Optimus, we consider revenue and earnings contributions in each scenario, and apply multiples based on comparable segments:

- Revenue Multiples: High-growth tech/robotics companies can trade at 5–10× revenue (or more, if growth is very high and profitability in sight).

- Optimistic: If Optimus revenue in 2029 is ~$5B and growth is 50%+ annually, a 10× multiple implies $50B segment value.

- Realistic: If revenue ~$1B and growth 30%, maybe a 5× multiple = $5B value (growing but not yet huge).

- Pessimistic: If revenue is <$0.1B, it’s immaterial; maybe valued at 0 or just seen as R&D.

- Earnings Multiples (P/E): If profitable, we can apply a P/E. However, in five years Optimus might still be scaling, so heavy reinvestment could depress reported earnings. In optimistic case, assume $1B profit, with a P/E of 50 → $50B. Realistic: $0.15B profit, maybe P/E 30 (less growthy) → ~$4.5B. Pessimistic: losses, so valued as optionality (say a few billion at best, or zero).

Total Tesla Market Cap: We then add this to Tesla’s base (the EV + energy + software business). Tesla’s current market cap is around ~$600B (as of early 2025). In five years, even without Optimus, Tesla could grow due to EV market expansion (some analysts see multi-trillion potential if autonomy, energy, etc., succeed). The Optimus segment could multiply Tesla’s value if successful or be marginal if not:

- Optimistic Total: Tesla could be well above $1T. For instance, ARK Invest’s bullish case sees ~$8T by 2030 with robotaxis. If we overlay Optimus success, some bulls talk about multi-trillion valuations (e.g., $2–3T). Musk’s extreme $25T claim is beyond 5-year scope and likely hyperbolic, but it frames how big the vision is.

- Realistic Total: Tesla maybe hits that $1–1.5T range by end of decade, with Optimus providing an extra 5-10% value uplift as the market waits for proof.

- Pessimistic Total: Tesla stays below $1T or even around current levels if EV market saturates or competition increases, and Optimus doesn’t excite investors.

Historical Automation Adoption Curves: Historically, the adoption of new automation tech (from industrial robots to personal computers) starts slow, then reaches an inflection point if value is clear:

- Industrial Robots: ~3 million in operation globally by 2021 after decades of growth; adoption was steady ~10-15% CAGR. A breakthrough like Optimus might accelerate the curve if it dramatically lowers cost or expands capabilities.

- PCs / Smartphones: Took 10-15 years from introduction to saturate the market. If robots follow a similar path, five years might only see early adopters, with a bigger boom coming later. Thus, a reasonable expectation is the realistic scenario, with exponential growth further out if/when the tech matures.

Risk Factors

Any valuation must be tempered by risks:

- Technological Challenges: Building a reliable humanoid is extremely hard. Vision, balance, dexterity, and general-purpose AI in unstructured environments are unsolved problems at scale. Tesla’s demos (e.g., Optimus dancing, doing basic tasks) are promising but still limitedbusinessinsider.com. There’s risk that Optimus cannot perform as advertised in real workplaces without extensive human oversight (teleoperation was used in demos). If the autonomy isn’t robust, adoption will stall.

- Production Delays: Tesla has a history of optimistic timelines. Musk said Optimus could be sold by end of 2024, but delays are possible. Any “production hell” or unforeseen manufacturing issues (like actuator yields, software bugs causing recalls, etc.) could slow rollout. If by 2027 Tesla still hasn’t delivered meaningful volume, the market will discount the hype.

- Competition: Tesla isn’t alone. Competitors include:

- Agility Robotics (Digit): Already setting up a factory for 10k/year and partnering with firms like Ford.

- Figure AI, Sanctuary, Apptronik – startups specifically working on humanoid robots, some with ex-NASA or Boston Dynamics talent. Also, Boston Dynamics (Hyundai) might eventually commercialize a humanoid (Atlas) or improved versions of Spot.

- Traditional Robot Makers: Companies like ABB, Fanuc, etc., might not make humanoids yet, but could introduce new automation solutions that cover much of the use-case at lower cost (e.g., collaborative robot arms paired with mobile bases).

- If a competitor cracks a particular niche (say warehouse box-lifting) with a simpler robot, they might dominate that niche over a generalist humanoid.

- Regulatory and Safety Hurdles: While there are no specific OSHA standards for robotics yet, safety regulations will evolve. Humanoid robots working around humans will need to be extremely safe (both physically and cyber-secure). Accidents involving robots could lead to public backlash or stricter rules (similar to how AV accidents slowed autonomous car enthusiasm). Governments might require certifications for robots in public spaces or labor law changes. Also, liability issues: who is responsible if a robot malfunctions and causes damage? Tesla will need robust safeguards (both hardware – emergency shutoffs, and software – reliable object/human recognition). Any high-profile incident could dampen adoption.

- Workforce and Societal Resistance: The idea of robots replacing human jobs will face resistance. Labor unions could lobby against robot deployments or demand contracts that limit job losses. Societal acceptance may depend on how displaced workers are handled. This could translate to political risk; e.g., incentives or penalties around automation might emerge (perhaps taxes on robots, as some have proposed, or conversely tax breaks for productivity). Public perception matters: if Optimus is seen as a job-killer or a security risk (hacking concerns), companies may be hesitant to adopt at large scale for fear of reputation or employee morale impact.

- Financial & Execution Risks: Tesla is investing heavily in this new venture. If the project overruns budgets or distracts management from core businesses, it could indirectly hurt Tesla’s financials. The company must execute on multiple fronts (EVs, energy, AI, and now robots). Execution missteps in one area could constrain resources for Optimus or vice versa.

In conclusion, Tesla’s Optimus humanoid robot segment could redefine the company’s growth trajectory – it’s a potential force multiplier for Tesla’s market cap, but one fraught with uncertainty. The next five years will likely show whether Optimus can move from impressive prototypes to a meaningful commercial product. Under optimistic conditions, widespread adoption yields Tesla a strong new revenue stream and propels its valuation toward the trillions, aligning with Musk’s grand vision of Tesla as “the most valuable company by far” via robots. In a realistic scenario, progress is steady but measured – Optimus becomes a valuable side business, enhancing Tesla’s narrative as a tech leader, but not transforming its finances overnight. In a pessimistic scenario, Optimus faces a slow grind, adding little value by 2030, reminding us that robotics revolutions often take longer than anticipated (if they materialize at all).

Investors and analysts will be watching key milestones: successful large-scale pilot programs, cost per robot trends, and any sign of the “hockey stick” adoption curve. As with past automation trends, adoption may start slowly before reaching a tipping point – and Tesla is positioning Optimus to be ready for when that moment comes.

Sources:

- Musk’s Optimus cost prediction and capabilities

- Tesla’s internal market share and margin expectations for robots

- International Federation of Robotics data on automation trends

- Agility Robotics’ production plans

- Reuters on humanoid robot challenges (Honda, startups)

- Elon Musk’s vision of Optimus long-term impact

- Research conducted by ChatGPT Deep Research

👉 Recommended Article: Tesla Bot Optimus: Is $5,000 per Share (TSLA) Realistic?